دورة المؤشرنت للتحليل الفني

50 دينار كويتي

أنت تستخدم أحد المتصفحات القديمة. قد لا يتم عرض هذا الموقع أو المواقع الأخرى بشكل صحيح.

يجب عليك ترقية متصفحك أو استخدام أحد المتصفحات البديلة.

يجب عليك ترقية متصفحك أو استخدام أحد المتصفحات البديلة.

Blue Earth Inc. BBLU

- بادئ الموضوع 2020

- تاريخ البدء

2020

عضو نشط

- التسجيل

- 5 فبراير 2012

- المشاركات

- 716

Blue Earth: Stock Tumbled, Should You Buy, Sell Or Hold?

Oct. 22, 2014 5:00 AM ET | 5 comments | About: Blue Earth, Inc. (BBLU)by: The Double or Nothing Trader

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. (More...)

Summary

A little after 10am EST yesterday morning, a company released a short report on Blue Earth, which led to shares falling 50% during the day, and rebounded 38% after the market closed and the company released a statement discounting the claims in the short report.

The stock traded on insane volume of 6.6 million, compared to its three month average of 351,000. The stock initially tried to hold onto the $1.50 level, but ultimately fell to a low on the day of just $1 - shares opened at $2.60.

The sad part is that the company's investor relations didn't come to the rescue while the market was open. Instead they made an announcement after the market closed and helped give some life back to the stock. Its shares rallied 38% with the last trade at $1.79 at 8pm EST.

I have seen a comment on Twitter about why wouldn't the stock rally right back to $2.60 once investors realize the short report was full of lies. Well, the short answer, no pun intended, is there has to be enough willing buyers. The stock fell so quick because there wasn't enough buyers willing to step in and risk catching a falling knife. As each investor was rushing to dump their shares, the stock falls lower and lower - it's a classic example of capitulating, where shares tank suddenly due to investor fear.

Today the company is in a great spot for a short squeeze. We will likely see many of these shorts cover on the open, which means they will be buying back their shares. Most of them will be locking in profits, but regardless of the reasoning, this additional buying power will put pressure on the stock to rise.

If you bought shares when I recommended them, or any time above $2, and haven't sold yet, I would put a stop in place to protect from further losses, around $1 if you can survive taking that hit to your investment account. If we don't see shares rebound quickly, they could stay in the dumps until the company proves these accusations are false - and sales improvements will be the only thing to help that. We get their next earnings announcement about two weeks into November, but any disappointment could send shares lower.

If you have a high risk tolerance as an investor, you could look to grab some shares at the open, but follow them with a tight stop, probably 5% to 10% trailing stop. Your goal would be to get in and ride quick bounce.

For longer term investors that want to use this as an entry point, I would follow it with a tighter stop-loss than normal, more on this at the bottom, but its largely because I want to see what the company has to say in November. If that means I am willing to miss out on the bounce back up to $2.60 for a chance to see what the company has to say about its third quarter, then so be it.

No matter what your situation is though, before you go making a quick trade, it's important to look into the accusations that were made on your own, and not rely on a blogger to give you every detail.

I wont get into all of the allegations in the short report, or analyze the response from the company, I feel it is better for you to start with both original articles. So, if you haven't already, take a read of The Pump Stopper's short report and Blue Earth's response.

This will give you a feel of what sort of allegations are being made. I will touch on a few of them.

Looking at the Report

First, it's important to understand that The Pump Stopper's sole reasoning behind creating a short report is to profit. The company benefits for instilling enough fear in investors to cause them to sell. You can tell this report took a few days to create, and wasn't thought of on a whim. But the reality is that if you just chose one side of an argument, it is pretty easy to manipulate data to align with your view - almost all bloggers do it.

But the evidence The Pump Stopper was benefiting from the price fall is blatant. Blue Earth had zero short interest until August 29, when someone shorted over 400,000 shares, or roughly 0.56% of shares outstanding. Then 10,000 more shares were shorted on September 15, increasing total shares shorted to 0.58% of shares outstanding. And on September 30, just 21 days before the short report was released, shares sold short jumped to 745,008, or 1.01% of shares outstanding. You can view this data here.

Plus, the company who created the short report has an email list that it sent the report to those subs first, before it landed at Seeking Alpha and toppled the shares, allowing those investors to front run the report's initial public debut.

The next important part to grasp is the valuation metrics used in the short report to come up with a price target - at this point it is anything but professional. In the report, it breaks the company down on a price-to-revenues per share basis to compare it to Tetra Tech (NASDAQ:TTEK), a company the report believes is a good comparison and superior to Blue Earth. Of course Blue Earth looks abysmal in comparison sitting at 12 times revenues compared to Tetra Tech which sits at just 0.8 times revenues. Implying that valuation to Blue Earth is how the short report comes to a conclusion of a 93% decline expectation in stock price - not really based on the best valuation tools out there, but I'll go with it.

I would like to add, however, that one comparison is hardly justification - so let's look at one more while we are at it. When you purchase a small cap like Blue Earth, you are purchasing it for expected growth, and that comes at a premium. So, just to give you another comparison, take Solar City (NASDAQ: SCTY), an installer and seller of solar energy systems, as an example. Solar City trades at 22 times revenues, which would make Blue Earth's 12 times revenues pretty attractive. If you imply a 22 multiple on revenues per share, Blue Earth could be trading at $3.70 today. But that wouldn't have helped the short report now would it?

The only other valuation metric is based on what the company has paid for in acquisitions, and taking that number to come up with a 67% decline in stock price. I like to look at price-to-book value if we are talking about a company that supposedly is worthless. With Blue Earth, prior to the short report and 50% drop in stock price, it commanded three times book value - which is well within reason for a company with strong growth potential. Blue Earth ended up closing the day sitting just about par with book value, which is a much better investing opportunity. To keep with my comparison above, Solar City trades at a multiple of 8.4 times its book value. But, back to the report at hand.

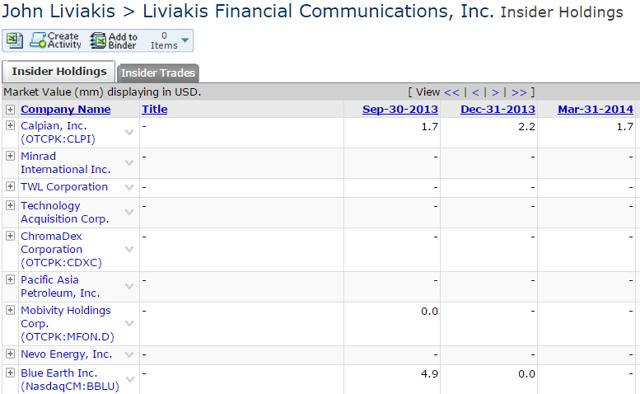

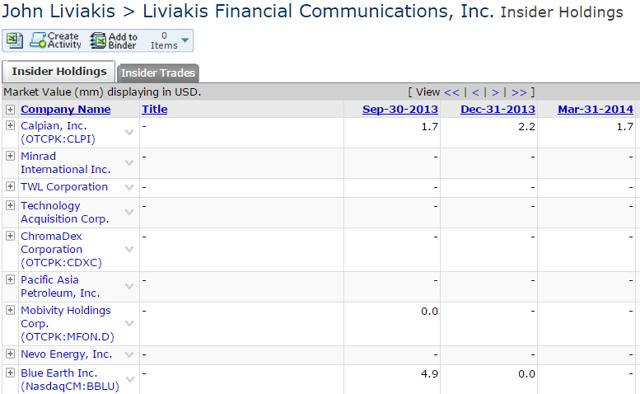

There is also a statement made in the short report, that a "stock promoter," John Liviakis, has "sold some or all of his BBLU stock." Well, after looking at his holdings according to Capital IQ, Liviakis has exited his position in the company, back in December of 2013. Clearly this isn't all that relevant to what is happening with shares today. It doesn't tell us much that he sold his shares a year ago after his promotion stint with the company was over - seems pretty logical if you ask me.

(click to enlarge)

Source: CapitalIQ

Liviakis Financial, however, as you will find out if you read the Blue Earth's statement, operates as Blue Earth's Investor Relations department.

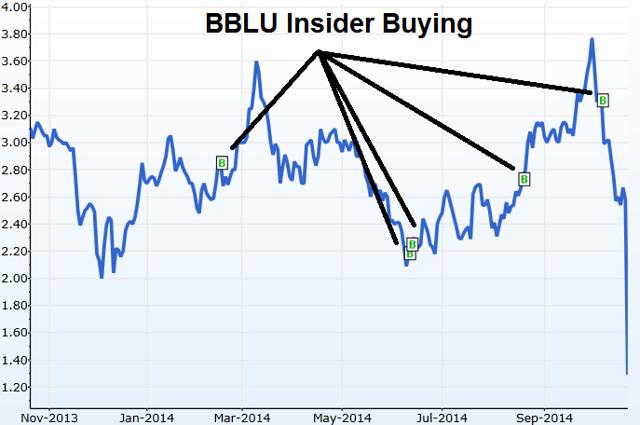

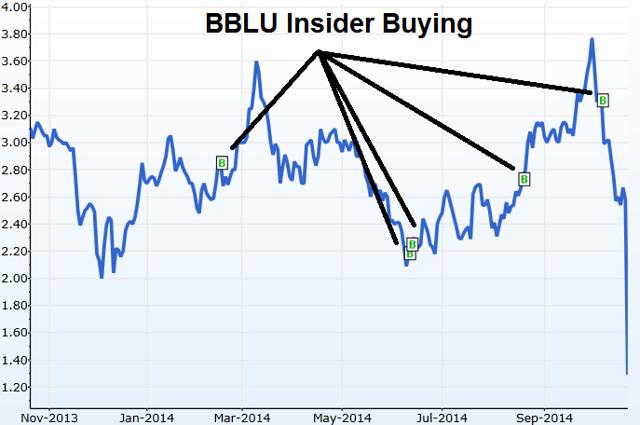

And if you look at the insider buying/selling this year, you will see that it is all buying.

(click to enlarge)

Source: CapitalIQ

As you can see, there was no selling - which what you would expect from a company that is founded on fraud.

A large chunk of the short report is tied to the current CEO, Larry Thomas, and his past experiences - even bringing up the past experiences of the auditors the company uses, and this is where John Liviakis mentioned above is brought into the picture. You can imagine these past experiences are far short of spectacular. They include sinking a couple companies, fraud and law suits. I feel bad even mentioning the lawsuits and fraud here though, but they were mentioned in the report. The outcome of the lawsuit was that it was dismissed and a few people with the lawsuit ended up going to jail over the lawsuits they pursued - which was conveniently left out of the report.

The report goes on to bash the company's opportunistic guidance that it falls short of, and lays out the story that the company simply won't live up to guidance going forward. The end result in the report is the company being bankrupt because it is expected to increase debt load to finance new projects.

The short report also cites a Freedom of Information request from the SEC. With that, The Pump Stopper concludes that "indicates to 'The Pump Stopper' there is evidence of some kind of law enforcement investigation" going on.

But, just a few sentences down from text that The Pump Stopper chose to highlight, the SEC request states "the assertion of this exemption should not be construed as an indication … that any violations of law have occurred."

Maybe it's just me, but making that leap is a bit stretched at this point - simply put, we need more information to make a verdict.

But, the Pump Stopper is still just connecting sporadic dots and instilling fear in investors - evidently it worked.

Without stringing together these jumbled dots, let's see what the company is working with.

Company Performance

The company's CEO is aggressively trying to grow the business. Of course, not many startups succeed, that's part of the risk in investing. But the company has been taking strides in the right direction, as you will see below with revenue growth, low debt levels, and compelling price-to-book value. Plus making it public is a big help to success, and getting listed on the Nasdaq in August is another stepping stone.

Being aggressive with acquisitions and opportunistic on sales is not a horrible thing - nothing worth shorting the stock over. It does mean the company will likely fall short of earnings expectation if the company has such high hopes and expectations, but without winning consistent contracts, revenues will remain sluggish and volatile.

Blue Earth has grown revenues by 72%, 21% and 30% in 2012, 2013 and so far through 2014 respectively. Based on the closing price yesterday, the company trades at 1.1 times book value, debt-to-equity sitting at 2.2%, and a current ratio of 3.8 times. Yes, the company operates at a loss, roughly $0.57 per share.

In the short term, this November earnings update could be critical to the direction the stock heads. Not only on the normal sales and operation results, but the company was supposed to complete its first CHP plant in September, with revenues coming after that. Blue Earth hasn't made a statement about it, but could very well be just waiting to discuss it with the quarterly announcement.

In the long term, the company needs to show us continued growth, win new contracts, and give us a path to profitability to get investors trust back.

Investors were shaken by the report, regardless of if the claims are false or not the damage is done, and it will likely keep out some of the longer term investors until mid-November at the earliest.

Your best bet is to jump in early in the morning, set a stop-loss, and ride a short squeeze higher as those shorts cover their profitable trades from the day before that are quickly going against them. I would maintain a trailing stop loss afterwards to protect the gains that are likely to come in the morning.

Every market is a traders market,

Double or Nothing

Oct. 22, 2014 5:00 AM ET | 5 comments | About: Blue Earth, Inc. (BBLU)by: The Double or Nothing Trader

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. (More...)

Summary

- Blue Earth stock tumbled after a short report was released in early trading yesterday.

- Blue Earth released a statement after the market closed that brought relief to the stock, setting up for a short squeeze opportunity this morning.

- The short report doesn't tell the whole story for Blue Earth, just focuses on past performances of CEO and risk associated with stock.

- As investors realize the report was just an opportunity for the company that provided it to profit, investors will push shares of Blue Earth higher.

A little after 10am EST yesterday morning, a company released a short report on Blue Earth, which led to shares falling 50% during the day, and rebounded 38% after the market closed and the company released a statement discounting the claims in the short report.

The stock traded on insane volume of 6.6 million, compared to its three month average of 351,000. The stock initially tried to hold onto the $1.50 level, but ultimately fell to a low on the day of just $1 - shares opened at $2.60.

The sad part is that the company's investor relations didn't come to the rescue while the market was open. Instead they made an announcement after the market closed and helped give some life back to the stock. Its shares rallied 38% with the last trade at $1.79 at 8pm EST.

I have seen a comment on Twitter about why wouldn't the stock rally right back to $2.60 once investors realize the short report was full of lies. Well, the short answer, no pun intended, is there has to be enough willing buyers. The stock fell so quick because there wasn't enough buyers willing to step in and risk catching a falling knife. As each investor was rushing to dump their shares, the stock falls lower and lower - it's a classic example of capitulating, where shares tank suddenly due to investor fear.

Today the company is in a great spot for a short squeeze. We will likely see many of these shorts cover on the open, which means they will be buying back their shares. Most of them will be locking in profits, but regardless of the reasoning, this additional buying power will put pressure on the stock to rise.

If you bought shares when I recommended them, or any time above $2, and haven't sold yet, I would put a stop in place to protect from further losses, around $1 if you can survive taking that hit to your investment account. If we don't see shares rebound quickly, they could stay in the dumps until the company proves these accusations are false - and sales improvements will be the only thing to help that. We get their next earnings announcement about two weeks into November, but any disappointment could send shares lower.

If you have a high risk tolerance as an investor, you could look to grab some shares at the open, but follow them with a tight stop, probably 5% to 10% trailing stop. Your goal would be to get in and ride quick bounce.

For longer term investors that want to use this as an entry point, I would follow it with a tighter stop-loss than normal, more on this at the bottom, but its largely because I want to see what the company has to say in November. If that means I am willing to miss out on the bounce back up to $2.60 for a chance to see what the company has to say about its third quarter, then so be it.

No matter what your situation is though, before you go making a quick trade, it's important to look into the accusations that were made on your own, and not rely on a blogger to give you every detail.

I wont get into all of the allegations in the short report, or analyze the response from the company, I feel it is better for you to start with both original articles. So, if you haven't already, take a read of The Pump Stopper's short report and Blue Earth's response.

This will give you a feel of what sort of allegations are being made. I will touch on a few of them.

Looking at the Report

First, it's important to understand that The Pump Stopper's sole reasoning behind creating a short report is to profit. The company benefits for instilling enough fear in investors to cause them to sell. You can tell this report took a few days to create, and wasn't thought of on a whim. But the reality is that if you just chose one side of an argument, it is pretty easy to manipulate data to align with your view - almost all bloggers do it.

But the evidence The Pump Stopper was benefiting from the price fall is blatant. Blue Earth had zero short interest until August 29, when someone shorted over 400,000 shares, or roughly 0.56% of shares outstanding. Then 10,000 more shares were shorted on September 15, increasing total shares shorted to 0.58% of shares outstanding. And on September 30, just 21 days before the short report was released, shares sold short jumped to 745,008, or 1.01% of shares outstanding. You can view this data here.

Plus, the company who created the short report has an email list that it sent the report to those subs first, before it landed at Seeking Alpha and toppled the shares, allowing those investors to front run the report's initial public debut.

The next important part to grasp is the valuation metrics used in the short report to come up with a price target - at this point it is anything but professional. In the report, it breaks the company down on a price-to-revenues per share basis to compare it to Tetra Tech (NASDAQ:TTEK), a company the report believes is a good comparison and superior to Blue Earth. Of course Blue Earth looks abysmal in comparison sitting at 12 times revenues compared to Tetra Tech which sits at just 0.8 times revenues. Implying that valuation to Blue Earth is how the short report comes to a conclusion of a 93% decline expectation in stock price - not really based on the best valuation tools out there, but I'll go with it.

I would like to add, however, that one comparison is hardly justification - so let's look at one more while we are at it. When you purchase a small cap like Blue Earth, you are purchasing it for expected growth, and that comes at a premium. So, just to give you another comparison, take Solar City (NASDAQ: SCTY), an installer and seller of solar energy systems, as an example. Solar City trades at 22 times revenues, which would make Blue Earth's 12 times revenues pretty attractive. If you imply a 22 multiple on revenues per share, Blue Earth could be trading at $3.70 today. But that wouldn't have helped the short report now would it?

The only other valuation metric is based on what the company has paid for in acquisitions, and taking that number to come up with a 67% decline in stock price. I like to look at price-to-book value if we are talking about a company that supposedly is worthless. With Blue Earth, prior to the short report and 50% drop in stock price, it commanded three times book value - which is well within reason for a company with strong growth potential. Blue Earth ended up closing the day sitting just about par with book value, which is a much better investing opportunity. To keep with my comparison above, Solar City trades at a multiple of 8.4 times its book value. But, back to the report at hand.

There is also a statement made in the short report, that a "stock promoter," John Liviakis, has "sold some or all of his BBLU stock." Well, after looking at his holdings according to Capital IQ, Liviakis has exited his position in the company, back in December of 2013. Clearly this isn't all that relevant to what is happening with shares today. It doesn't tell us much that he sold his shares a year ago after his promotion stint with the company was over - seems pretty logical if you ask me.

(click to enlarge)

Source: CapitalIQ

Liviakis Financial, however, as you will find out if you read the Blue Earth's statement, operates as Blue Earth's Investor Relations department.

And if you look at the insider buying/selling this year, you will see that it is all buying.

(click to enlarge)

Source: CapitalIQ

As you can see, there was no selling - which what you would expect from a company that is founded on fraud.

A large chunk of the short report is tied to the current CEO, Larry Thomas, and his past experiences - even bringing up the past experiences of the auditors the company uses, and this is where John Liviakis mentioned above is brought into the picture. You can imagine these past experiences are far short of spectacular. They include sinking a couple companies, fraud and law suits. I feel bad even mentioning the lawsuits and fraud here though, but they were mentioned in the report. The outcome of the lawsuit was that it was dismissed and a few people with the lawsuit ended up going to jail over the lawsuits they pursued - which was conveniently left out of the report.

The report goes on to bash the company's opportunistic guidance that it falls short of, and lays out the story that the company simply won't live up to guidance going forward. The end result in the report is the company being bankrupt because it is expected to increase debt load to finance new projects.

The short report also cites a Freedom of Information request from the SEC. With that, The Pump Stopper concludes that "indicates to 'The Pump Stopper' there is evidence of some kind of law enforcement investigation" going on.

But, just a few sentences down from text that The Pump Stopper chose to highlight, the SEC request states "the assertion of this exemption should not be construed as an indication … that any violations of law have occurred."

Maybe it's just me, but making that leap is a bit stretched at this point - simply put, we need more information to make a verdict.

But, the Pump Stopper is still just connecting sporadic dots and instilling fear in investors - evidently it worked.

Without stringing together these jumbled dots, let's see what the company is working with.

Company Performance

The company's CEO is aggressively trying to grow the business. Of course, not many startups succeed, that's part of the risk in investing. But the company has been taking strides in the right direction, as you will see below with revenue growth, low debt levels, and compelling price-to-book value. Plus making it public is a big help to success, and getting listed on the Nasdaq in August is another stepping stone.

Being aggressive with acquisitions and opportunistic on sales is not a horrible thing - nothing worth shorting the stock over. It does mean the company will likely fall short of earnings expectation if the company has such high hopes and expectations, but without winning consistent contracts, revenues will remain sluggish and volatile.

Blue Earth has grown revenues by 72%, 21% and 30% in 2012, 2013 and so far through 2014 respectively. Based on the closing price yesterday, the company trades at 1.1 times book value, debt-to-equity sitting at 2.2%, and a current ratio of 3.8 times. Yes, the company operates at a loss, roughly $0.57 per share.

In the short term, this November earnings update could be critical to the direction the stock heads. Not only on the normal sales and operation results, but the company was supposed to complete its first CHP plant in September, with revenues coming after that. Blue Earth hasn't made a statement about it, but could very well be just waiting to discuss it with the quarterly announcement.

In the long term, the company needs to show us continued growth, win new contracts, and give us a path to profitability to get investors trust back.

Investors were shaken by the report, regardless of if the claims are false or not the damage is done, and it will likely keep out some of the longer term investors until mid-November at the earliest.

Your best bet is to jump in early in the morning, set a stop-loss, and ride a short squeeze higher as those shorts cover their profitable trades from the day before that are quickly going against them. I would maintain a trailing stop loss afterwards to protect the gains that are likely to come in the morning.

Every market is a traders market,

Double or Nothing

2020

عضو نشط

- التسجيل

- 5 فبراير 2012

- المشاركات

- 716

تستاهل الشكر من بعد الله على المجهود الطيب الله يوفقك

جزاك الله خير

من طيبك وأسال الله للجميع التوفيق

دورة المؤشرنت للتحليل الفني

50 دينار كويتي